Which Of The Following Fiscal Policy Changes Would Be The Most Contractionary

In economic science and political science, financial policy is the use of government acquirement collection (taxes or tax cuts) and expenditure to influence a country's economic system. The use of government acquirement expenditures to influence macroeconomic variables developed in reaction to the Swell Depression of the 1930s, when the previous laissez-faire approach to economic management became unworkable. Fiscal policy is based on the theories of the British economist John Maynard Keynes, whose Keynesian economics theorized that regime changes in the levels of taxation and government spending influence amass demand and the level of economic activeness. Fiscal and monetary policy are the key strategies used by a country's government and primal bank to advance its economical objectives. The combination of these policies enables these authorities to target inflation (which is considered "healthy" at the level in the range 2%–iii%) and to increase employment. Additionally, it is designed to try to keep GDP growth at two%–three% and the unemployment rate near the natural unemployment charge per unit of 4%–v%.[1] This implies that financial policy is used to stabilize the economy over the grade of the business wheel.[2]

Changes in the level and composition of taxation and government spending can touch macroeconomic variables, including:

- amass demand and the level of economic activity

- saving and investment

- income distribution

- resource allotment of resource.

Fiscal policy can exist distinguished from monetary policy, in that financial policy deals with taxation and government spending and is oftentimes administered by a authorities department; while monetary policy deals with the money supply, interest rates and is oftentimes administered by a country'south key banking concern. Both fiscal and monetary policies influence a country'south economical functioning.

Budgetary or fiscal policy? [edit]

Since the 1970s, it became clear that monetary policy performance has some benefits over fiscal policy due to the fact that it reduces political influence, every bit it is set by the fundamental bank (to take an expanding economy before the full general election, politicians might cut the involvement rates). Additionally, financial policy can potentially have more supply-side effects on the economy: to reduce inflation, the measures of increasing taxes and lowering spending would not be preferred, so the government might be reluctant to utilise these. Monetary policy is generally quicker to implement as involvement rates can exist set every month, while the conclusion to increment regime spending might take time to figure out which area the money should exist spent on.[3]

The recession of the 2000s decade shows that monetary policy also has sure limitations. A liquidity trap occurs when interest rate cuts are insufficient equally a demand booster equally banks do not want to lend and the consumers are reluctant to increase spending due to negative expectations for the economy. Government spending is responsible for creating the need in the economic system and can provide a kick-start to get the economy out of the recession. When a deep recession takes place, it is not sufficient to rely just on monetary policy to restore the economic equilibrium.[3] Each side of these two policies has its differences, therefore, combining aspects of both policies to deal with economic problems has become a solution that is now used by the The states. These policies accept express effects; however, fiscal policy seems to have a greater effect over the long-run period, while monetary policy tends to have a short-run success.[iv]

In 2000, a survey of 298 members of the American Economic Association (AEA) found that while 84 percent mostly agreed with the argument "Fiscal policy has a meaning stimulative impact on a less than fully employed economy", 71 per centum also generally agreed with the statement "Management of the business organisation cycle should exist left to the Federal Reserve; activist fiscal policy should be avoided."[5] In 2011, a follow-up survey of 568 AEA members found that the previous consensus about the latter proffer had dissolved and was by then roughly evenly disputed.[half-dozen]

Stances [edit]

Depending on the state of the economic system, fiscal policy may attain for different objectives: its focus can be to restrict economic growth by mediating aggrandizement or, in turn, increase economical growth by decreasing taxes, encouraging spending on different projects that act as stimuli to economic growth and enabling borrowing and spending. The three stances of fiscal policy are the post-obit:

- Neutral fiscal policy is usually undertaken when an economy is in neither a recession nor an expansion. The amount of government deficit spending (the excess not financed past revenue enhancement revenue) is roughly the same equally it has been on average over time, then no changes to it are occurring that would have an effect on the level of economic action.

- Expansionary financial policy is used by the government when trying to balance the contraction phase in the business cycle. It involves authorities spending exceeding tax revenue by more than than it has tended to, and is usually undertaken during recessions. Examples of expansionary financial policy measures include increased government spending on public works (e.g., building schools) and providing the residents of the economic system with tax cuts to increment their purchasing power (in order to fix a decrease in the need).

- Contractionary financial policy, on the other hand, is a measure to increase revenue enhancement rates and decrease authorities spending. Information technology occurs when government arrears spending is lower than usual. This has the potential to slow economic growth if aggrandizement, which was caused past a significant increase in aggregate demand and the supply of money, is excessive. Past reducing the economy's amount of aggregate income, the available amount for consumers to spend is besides reduced. So, contractionary fiscal policy measures are employed when unsustainable growth takes place, leading to inflation, loftier prices of investment, recession and unemployment in a higher place the "good for you" level of three%–four%.

Notwithstanding, these definitions tin can be misleading because, even with no changes in spending or tax laws at all, circadian fluctuations of the economy crusade cyclic fluctuations of tax revenues and of some types of authorities spending, altering the arrears situation; these are not considered to exist policy changes. Therefore, for purposes of the above definitions, "regime spending" and "revenue enhancement acquirement" are commonly replaced by "cyclically adapted government spending" and "cyclically adjusted tax revenue". Thus, for example, a authorities upkeep that is counterbalanced over the course of the business wheel is considered to represent a neutral and effective financial policy stance.

Methods of fiscal policy funding [edit]

Governments spend money on a wide variety of things, from the armed services and police to services such as education and health care, every bit well every bit transfer payments such as welfare benefits. This expenditure can be funded in a number of different ways:

- Taxation

- Seigniorage, the benefit from printing money

- Borrowing coin from the population or from abroad

- Dipping into fiscal reserves

- Sale of fixed assets (due east.chiliad., country)

- Selling equity to the population

Borrowing [edit]

A fiscal arrears is often funded by issuing bonds such as Treasury bills or and gold-edged securities but can also be funded by issuing equity. Bonds pay involvement, either for a stock-still period or indefinitely that is funded by taxpayers as a whole. Equity offers returns on investment (interest) that can just be realized in discharging a futurity tax liability past an private taxpayer. If available government revenue is insufficient to support the interest payments on bonds, a nation may default on its debts, usually to foreign creditors. Public debt or borrowing refers to the government borrowing from the public. It is impossible for a government to "default" on its equity since the total returns bachelor to all investors (taxpayers) are express at whatever point by the total current year taxation liability of all investors.

Dipping into prior surpluses [edit]

A fiscal surplus is often saved for future use, and may exist invested in either local currency or any financial instrument that may exist traded later in one case resources are needed and the boosted debt is non needed.

Fiscal straitjacket [edit]

The concept of a fiscal straitjacket is a general economic principle that suggests strict constraints on government spending and public sector borrowing, to limit or regulate the budget deficit over a time menses. Most US states take counterbalanced upkeep rules that prevent them from running a deficit. The United States federal government technically has a legal cap on the total amount of money it tin borrow, but it is not a meaningful constraint because the cap tin can exist raised as hands as spending tin can exist authorized, and the cap is almost always raised before the debt gets that high.

Economic effects [edit]

Governments use fiscal policy to influence the level of aggregate demand in the economy, and then that certain economic goals can exist achieved:

- Toll stability;

- Full employment;

- Economic growth.

The Keynesian view of economics suggests that increasing government spending and decreasing the rate of taxes are the all-time means to have an influence on aggregate demand, stimulate information technology, while decreasing spending and increasing taxes after the economic expansion has already taken place. Additionally, Keynesians fence that expansionary financial policy should exist used in times of recession or low economical activity as an essential tool for edifice the framework for stiff economic growth and working towards full employment. In theory, the resulting deficits would be paid for past an expanded economy during the expansion that would follow; this was the reasoning backside the New Bargain.

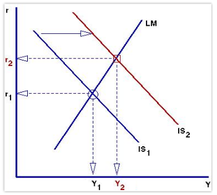

The IS bend shifts to the right, increasing existent interest rates (r) and expansion in the "real" economy (real GDP, or Y).

The IS-LM model is another manner of understanding the effects of fiscal expansion. As the government increases spending, in that location will be a shift in the IS bend up and to the correct. In the short run, this increases the real interest rate, which then reduces individual investment and increases amass demand, placing upward pressure on supply. To encounter the brusk-run increase in aggregate demand, firms increase full-employment output. The increment in short-run price levels reduces the money supply, which shifts the LM bend dorsum, and thus, returning the general equilibrium to the original full employment (FE) level. Therefore, the IS-LM model shows that there will be an overall increment in the price level and real involvement rates in the long run due to fiscal expansion.[vii]

Governments can use a upkeep surplus to do two things:

- to slow the pace of potent economic growth;

- to stabilize prices when inflation is also high.

Keynesian theory posits that removing spending from the economic system volition reduce levels of aggregate demand and contract the economy, thus stabilizing prices.

But economists still contend the effectiveness of fiscal stimulus. The argument mostly centers on crowding out: whether government borrowing leads to college involvement rates that may beginning the stimulative impact of spending. When the authorities runs a budget arrears, funds will need to come from public borrowing (the issue of authorities bonds), overseas borrowing, or monetizing the debt. When governments fund a arrears with the issuing of regime bonds, interest rates can increase across the marketplace, because regime borrowing creates higher need for credit in the financial markets. This decreases aggregate demand for goods and services, either partially or entirely offsetting the straight expansionary affect of the arrears spending, thus diminishing or eliminating the achievement of the objective of a fiscal stimulus. Neoclassical economists generally emphasize crowding out while Keynesians argue that financial policy tin can still be effective, especially in a liquidity trap where, they contend, crowding out is minimal.[eight]

In the classical view, expansionary financial policy likewise decreases net exports, which has a mitigating event on national output and income. When authorities borrowing increases interest rates it attracts strange capital from foreign investors. This is because, all other things being equal, the bonds issued from a country executing expansionary financial policy at present offering a higher rate of return. In other words, companies wanting to finance projects must compete with their government for capital so they offer higher rates of return. To purchase bonds originating from a certain state, foreign investors must obtain that country's currency. Therefore, when foreign capital letter flows into the country undergoing fiscal expansion, demand for that country's currency increases. The increased demand, in turn, causes the currency to appreciate, reducing the price of imports and making exports from that state more expensive to foreigners. Consequently, exports decrease and imports increase, reducing need from net exports.

Some economists oppose the discretionary use of fiscal stimulus because of the inside lag (the time lag involved in implementing it), which is almost inevitably long because of the substantial legislative effort involved. Further, the outside lag between the time of implementation and the time that about of the furnishings of the stimulus are felt could mean that the stimulus hits an already-recovering economic system and overheats the ensuing h rather than stimulating the economy when it needs it.

Some economists are concerned well-nigh potential inflationary furnishings driven by increased demand engendered by a financial stimulus. In theory, fiscal stimulus does not cause inflation when it uses resources that would have otherwise been idle. For instance, if a fiscal stimulus employs a worker who otherwise would accept been unemployed, at that place is no inflationary effect; nonetheless, if the stimulus employs a worker who otherwise would have had a task, the stimulus is increasing labor demand while labor supply remains fixed, leading to wage aggrandizement and therefore price aggrandizement.

See also [edit]

- Econometrics

- Fiscal Observatory of Latin America and the Caribbean

- Financial policy of the Us

- Fiscal union

- Functional finance

- Interaction between monetary and fiscal policies

- Monetary policy

- National fiscal policy response to the late 2000s recession

- Policy mix

- Revenue enhancement policy

References [edit]

- ^ Kramer, Leslie. "What Is Fiscal Policy?". Investopedia. Dotdash. Retrieved April 26, 2019.

- ^ O'Sullivan, Arthur; Sheffrin, Steven Grand. (2003). Economics: Principles in Action. Upper Saddle River, New Bailiwick of jersey: Pearson Prentice Hall. p. 387. ISBN978-0-thirteen-063085-8.

- ^ a b Pettinger, Tejvan. "Deviation between monetary and fiscal policy". Economics.Help.org. Economics.Assist.org. Retrieved April 26, 2019.

- ^ Schmidt, Michael. "A Look at Financial and Monetary Policy". Invetopedia. Dotdash. Retrieved Apr 26, 2019.

- ^ Fuller, Dan; Geide-Stevenson, Doris (Fall 2003). "Consensus Amid Economists: Revisited". The Journal of Economic Education. 34 (4): 369–387. doi:ten.1080/00220480309595230. JSTOR 30042564.

- ^ Fuller, Dan; Geide-Stevenson, Doris (2014). "Consensus Among Economists – An Update". The Journal of Economical Didactics. Taylor & Francis. 45 (2): 131–146. doi:10.1080/00220485.2014.889963.

- ^ Acemoglu, Daron; David I. Laibson; John A. List (2018). Macroeconomics (Second ed.). New York. ISBN978-0-13-449205-half-dozen. OCLC 956396690.

- ^ "Cliff Notes, Economic Effecs of Fiscal Policy". Archived from the original on April x, 2013. Retrieved March 20, 2013.

Bibliography [edit]

- Simonsen, Chiliad.H. The Econometrics and The State Brasilia Academy Editor, 1960–1964.

- Heyne, P. T., Boettke, P. J., Prychitko, D. Fifty. (2002). The Economical Way of Thinking (10th ed). Prentice Hall.

- Larch, M. and J. Nogueira Martins (2009). Fiscal Policy Making in the European Union: An Assessment of Current Do and Challenges. Routledge.

- Hansen, Bent (2003). The Economic Theory of Fiscal Policy, Volume three. Routledge.

- Anderson, J. Due east. (2005). Fiscal Reform and its Firm-Level Furnishings in Eastern Europe and Fundamental Asia, Working Papers Series wp800, William Davidson Found at the University of Michigan.

- D. Harries. Roger Fenton and the Crimean War

- Schmidt, M (2018). "A Await at Fiscal and Monetary Policy", Dotdash

- Pettinger, T. (2017). "Difference between budgetary and financial policy", EconmicsHelp.org

- Amadeo, K. (2018). "Financial Policy Types, Objectives, and Tools", Dotdash

- Kramer, L. (2019). "What Is Fiscal Policy?", Dotdash

- Macek, R; Janků, J. (2015) "The Impact of Fiscal Policy on Economic Growth Depending on Institutional Weather condition"

External links [edit]

- Fiscal Policy topic folio from britannica.com

Source: https://en.wikipedia.org/wiki/Fiscal_policy

Posted by: truesdalehimat1991.blogspot.com

0 Response to "Which Of The Following Fiscal Policy Changes Would Be The Most Contractionary"

Post a Comment